What does producing more energies but with fewer emissions really mean?

A. H. / In 2015, the Company decided to reduce its Scope 1 and 2 emissions, which are related to operations at our industrial sites. This involves various solutions. Since 2023, we have been implementing an energy efficiency plan backed by a $1 billion investment that has already served to avoid the emission of two million metric tons of CO2 a day (see the article on page 09). We have also committed to ending routine flaring by 2030; to installing equipment that continuously detects methane leaks at our upstream oil and gas sites, and to electrifying our processes by 2025; and to purchasing renewable electricity and low-carbon hydrogen to cover the needs of our European refineries, by 2030. These engagements are accompanied by precise objectives, year by year, and highly concrete results. While our objectives on emissions reductions for 2030 remain the same, our objectives for 2025 have all been raised. Why? Because we have performed better than planned, given the efforts undertaken.

Concerning the energy systems transition, there is no better measure of our contribution than the CO2 carbon intensity of the energy mix that we sell to our customers. We communicate on this metric in our carbon intensity indicator, which measures the life-cycle CO2 content, including the production, transformation, transport, sale and use of the products that we sell to our customers. And the carbon intensity of the products we sell decreased by 16.5% between 2015 and 2024. We also met this objective earlier than planned, so we have increased the target for 2025 to under 17%.

How does this strategy tie in with a sustainable growth strategy?

A. H. / To respond to growing demand, the Company aims to increase its energy production (hydrocarbons and electricity) by 4% a year between now and 2030 and is highly favorably positioned to take advantage of energy prices. This has been made possible by refocusing the oil and gas portfolio on assets and projects with a low break-even and low greenhouse gas emissions, and also by diversifying into electricity, notably renewable, and covering the entire value chain, from production to customer. This strategy is producing results, since, for the third year in a row, we are the most profitable major, with a solid balance sheet and a low gearing ratio. These results enable us to lead an attractive returns policy for shareholders; our dividend is rising constantly, having increased by an annual 7% in the last three years. All of this shows that, as an energy company, we are following through on our promises and delivering more energies, fewer emissions, and higher returns for shareholders.

The energy transition: a collective transition

The energy transition calls for the contribution of all stakeholders, from customers and industrial entities to regulatory States. TotalEnergies is leading a strategy that supports this collective transition, and which enables our Company to adapt to the various scenarios likely to play out in line with trends in low-carbon technologies (broader take-up, reduced cost), geopolitical relations, international dialogue, and consumer behavior.

Two pillars to support our transition strategy

Oil & Gas

Integrated Power

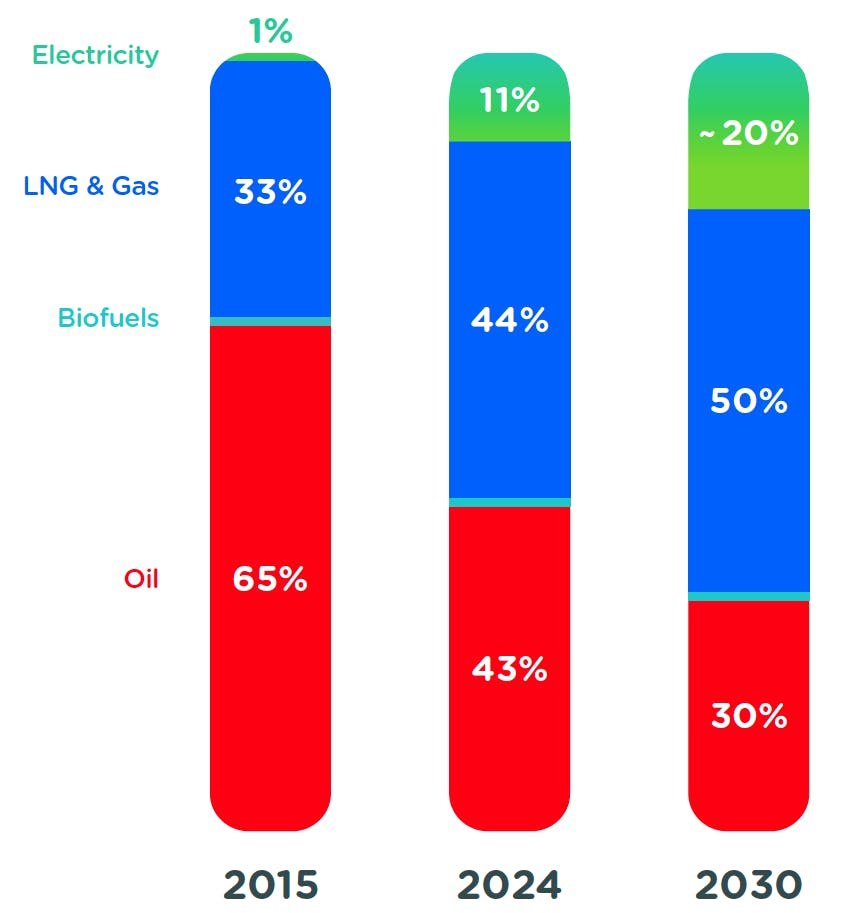

TotalEnergies’ sales mix

This graph shows TotalEnergies' sales mix.

Year 2015:

- Oil: 65%

- LNG & Gas: 33%

- Electricity: 1%

- Biofuels: (visually represented, but not quantified)

Year 2024:

- Oil: 43%

- LNG & Gas: 44%

- Electricity: 11%

- Biofuels: (visually represented, but not quantified)

Year 2030 (forecast):

- Oil: 30%

- LNG & Gas: 50%

- Electricity: approximately 20%

- Biofuels: (visually represented, but not quantified)